Understanding Asset Planning

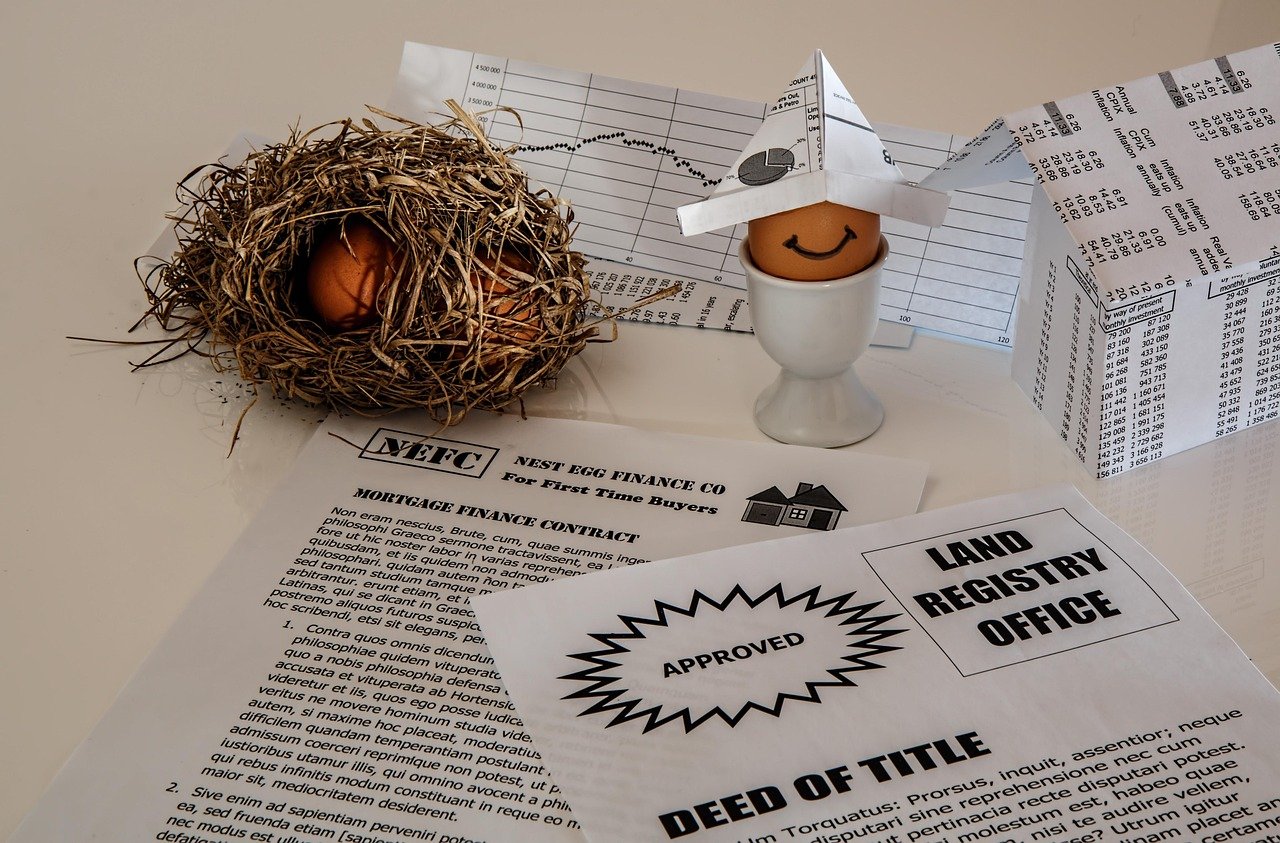

Asset planning isn’t just a buzzword; it’s a critical component of effective financial management. Are you ready to take control of your financial future? Asset planning involves organizing and managing your assets to ensure they meet your long-term financial goals. It encompasses everything from investments and property to cash reserves and retirement accounts. The goal is to maximize the value of these assets while minimizing risks and taxes.

Many people overlook the importance of a solid asset planning strategy. They often think that simply having assets is enough. However, without a proper plan, you might not be leveraging your assets effectively. By actively planning how to allocate and grow your wealth, you not only secure your financial future but also enhance your overall quality of life. This includes understanding your assets’ roles in your financial portfolio and how they can work together to meet your needs.

The Importance of Asset Planning

Why is asset planning so crucial? For starters, it helps you identify your financial goals. Whether you aim to buy a home, save for your children’s education, or prepare for retirement, having a clear plan is essential. Asset planning enables you to see the bigger picture. It allows you to track your progress toward these goals and adjust your strategy as needed.

Moreover, effective asset planning can significantly reduce your tax liabilities. By understanding how different assets are taxed, you can make smarter decisions. For example, investing in tax-advantaged accounts like IRAs or 401(k)s can help you grow your retirement savings while minimizing your tax burden. In short, asset planning not only keeps you organized but also positions you for financial success.

Key Components of Asset Planning

When you embark on asset planning, there are several key components to consider:

- Asset Inventory: Begin by taking stock of all your assets. This includes cash, real estate, investments, and personal property. Knowing what you have is the foundation of effective planning.

- Risk Assessment: Assess the risks associated with your assets. Are they well-diversified? Could a market downturn severely impact their value? Understanding risk helps you make informed decisions.

- Financial Goals: What do you want to achieve? Establish clear, measurable goals that guide your asset planning process.

- Tax Implications: Understand how your asset choices affect your taxes. Some investments are more tax-efficient than others.

- Estate Planning: Consider how your assets will be distributed after your passing. Having a plan in place ensures your wishes are honored and can reduce tax liabilities for your heirs.

These components work together to create a cohesive asset planning strategy. By addressing each area, you’ll be better positioned to manage your financial future. Choosing the Right Factoring Company for Your Business

Steps to Effective Asset Planning

Ready to get started? Here’s a step-by-step guide to effective asset planning:

- Gather Financial Information: Collect all relevant financial documents, including statements for bank accounts, investment accounts, and any other assets.

- Identify Goals: Clearly outline your short-term and long-term financial goals. Write them down to keep them top of mind.

- Analyze Your Current Assets: Look at your asset inventory and assess their performance. Are they aligned with your goals?

- Consult a Financial Advisor: If you feel overwhelmed, consider seeking professional advice. An advisor can help tailor a plan to your specific needs.

- Implement Your Plan: Put your asset planning strategy into action. This may include reallocating investments or purchasing new assets.

- Review Regularly: Your financial situation and goals may change over time. Regularly reviewing and adjusting your asset plan ensures you stay on track.

By following these steps diligently, you’ll create a solid foundation for your financial future.

Common Mistakes in Asset Planning

Even the most seasoned investors can make mistakes in asset planning. Here are some common pitfalls to avoid:

- Neglecting to Diversify: Many individuals stick to a few types of investments. Diversifying your assets helps reduce risk.

- Ignoring Tax Consequences: Failing to consider the tax implications of your asset decisions can lead to unexpected liabilities.

- Not Updating Your Plan: Life changes—like marriage, having children, or changing jobs—can affect your financial goals. Make sure to update your asset plan regularly.

- Underestimating Expenses: Be realistic about your expenses when planning. Unexpected costs can derail even the best plans.

Awareness of these mistakes can help you steer clear of common traps, ensuring your asset planning is effective and efficient.

Tools for Effective Asset Planning

In today’s digital age, numerous tools can aid in asset planning. From budgeting apps to investment trackers, leveraging technology can simplify the process: Your Guide to Choosing a Structured Settlement Buyer

- Budgeting Software: Tools like Mint or YNAB (You Need A Budget) help track your income and expenses, providing clarity on your financial situation.

- Investment Tracking Apps: Apps like Personal Capital give you insights into your investment performance and help with retirement planning.

- Retirement Calculators: Online calculators can estimate how much you need to save to achieve your retirement goals.

- Financial Planning Platforms: Services like Betterment or Wealthfront offer automated investment management, which can be beneficial for hands-off investors.

By utilizing these tools, you can enhance your asset planning efforts, making them more efficient and effective.

FAQs

What is the primary goal of asset planning?

The primary goal of asset planning is to organize and manage your assets to achieve your financial objectives while minimizing risks and taxes.

How often should I review my asset plan?

It’s advisable to review your asset plan at least annually or after any significant life changes, such as marriage or a new job.

Can I handle asset planning myself?

Yes, many people manage their asset planning on their own. However, consulting a financial advisor can provide personalized insights and strategies.

What types of assets should I include in my plan?

Include all types of assets, such as cash, real estate, stocks, bonds, and retirement accounts.

Are there any tax benefits to asset planning?

Yes, effective asset planning can help minimize taxes through strategies like investing in tax-advantaged accounts.